|

| |

|

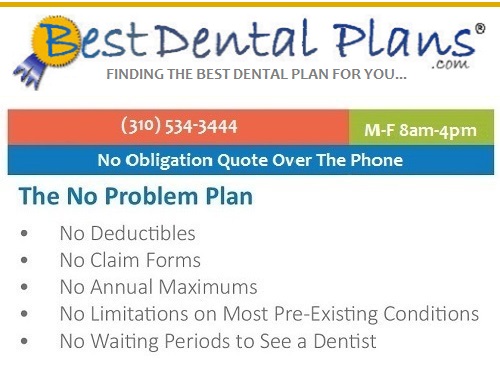

We offer the Best Dental Insurance Plans

Indemnity Dental Plans

Affordable Dental Plans

Dental Plans - HMOsThese insurance plans, also known as "capitation plans," operate like their medical HMO cousins. This type of dental plan provides a comprehensive dental care to enrolled patients through designated provider office. A Dental Health Maintenance Organization (DHMO) is a common example of a capitation plan. The dental office provider is paid on a per capita (per person) basis rather than for actual treatment provided. Participating individual and family dental offices receive a fixed monthly fee based on the number of patients assigned to the office. In addition to premiums, client co-payments may be required for each visit. Some typical features of these plans:

Preferred Provider OrganizationsAnother true insurance plan, a Preferred provider organizations (PPO) falls somewhere between an indemnity plan and a dental HMO. This plan allows a particular group of patients to receive dental care from a defined panel of individual or family dental facility. The participating individual or family provider agrees to charge less than usual fees to this specific patient base, providing savings for the plan purchaser. If the patient chooses to see a dental specialists who is not designated as a "preferred provider," that patient may be required to pay a greater share of the fee-for-service. A group of individual and family dental offices agree to provide services at a deeply discounted rate, giving you substantial savings — as long as you stay in their network. Unlike the more restrictive DHMO, though, you can go out of network and still receive some benefits. Some typical features of these plans:

What are Dental Discount Plans - Remember they are not insuranceThis type of dental plan is not insurance. The managing organizations have negotiated with local dental offices to establish a set price for a particular dental procedure and offer deep discounts (some up to 70%) off the regular ADA pricing code. This plan has several advantages over traditional dental insurance plans, namely, there are no exclusions for pre-existing conditions. This allows a patient to receive immediate coverage for work without meeting any waiting period requirements. How do discount dental plans work? As we become aware about our oral health, there has been a demand for affordable dental care. Discount dental plans are the newest option for those without coverage. These dental discount plans are much cheaper than traditional dental insurance, and also offer almost equal coverage for all dental work, even cosmetic procedures not covered by standard indemnity dental plans. Dental Dental Insurance for the Best PriceThe catch is that dental discount plans are not really insurance at all. They work more like club memberships, where the cost of membership (your "premium") earns a steep discount on any club service (dental work) you buy. The discount normally applies to all dental office services performed by an approved "plan" individual or family dental providers, but no procedure is covered completely. What are the ins and outs of discount dental plans? When it comes to dental discount plans, the good news is afford ability, breadth of services, and immediate coverage. The bad news is greater financial risk and responsibility on your part. Supplemental Dental Insurance InsuranceAlthough the monthly cost of most discount dental plans is very low compared to the price of a traditional dental insurance or indemnity insurance policy, there's more allover financial risk with a dental discount plan. No care is totally covered, so an expensive procedure will mean a big out-of-pocket expense, even with the dental plan. And even when undergoing a low-cost service (like cleaning), you'll still be expected to pick up a part of the cost. However, on the plus side, discount dental plans are effective immediately - so are many procedures you need now will be covered as soon as you buy the dental discount plan. Traditional indemnity and/or insurance dental plans usually impose a waiting period of between 6 and 18 months for any major procedure. The last "pro" is that all good dental discount plans should come with a money-back guarantee. Direct Reimbursement PlansA dental care plan now coming into vogue is the direct reimbursement plan. This is a self-funded benefit plan — not insurance — in which an employer pays for dental care with its own funds, rather than paying premiums to an insurance company or third-party administrator. You, the patient, pay the full

amount directly to the individual or family dental care provider, then get a receipt

detailing services rendered and the cost, which you show to your employer. The

employer reimburses you for part or all of the dental costs, depending on your

specific benefits. Some typical features of a direct reimbursement plan:

What do you look for in choosing a dental insurance plan?Does the plan give you the freedom to choose your own individual or family dental place or are you restricted to a network panel selected by the insurance company? If you have a family helper with whom you are satisfied, consider the effects changing offices will have on the quality or quantity of care you receive. Because regular visits to the dental location reduce the likelihood of developing serious dental disease, it's best to have and maintain an established relationship with an individual or family dental office you trust and accepts the dental insurance plan you purchase. Who controls treatment decisions--you and your dental office or the dental plan? Many plans require the office to follow treatment plans that rely on a Least Expensive Alternative Treatment (LEAT) approach. If there are multiple treatment options for a specific condition, the plan will pay for the less expensive treatment option. If you choose a treatment option that may better suit your individual needs and your long-term oral health, you will be responsible for paying the difference in costs. It's important to know who makes the treatment decisions under your plan. These cost control measures may have an impact on the quality of care you'll receive. Does the plan cover diagnostic, preventive and emergency services? If so, to what extent? Most dental plans provide coverage for selected diagnostic services, preventive care and emergency treatment that are basic for maintaining good oral health. But the extent or frequency of the services covered by some plans may be limited. Depending upon your individual oral health needs, you may be required to them directly for a portion of this basic care. Find out how much treatment is allowed in any given year without cost to you, and how much you will have to pay for yourself.

What routine corrective treatment is covered by the dental plan? What share of the costs will be yours? While preventive care lessens the risk of serious dental disease, additional treatment may be required to ensure optimal health. A broad range of treatment can be defined as routine. Most plans cover 70 percent to 80 percent of such treatment. Patients are responsible for the remaining costs. Examples of routine care include:

What major dental care is covered by the plan? What percentage of these costs will you be required to pay? Since dental benefits encourage you to get preventive care, which often eliminates the need for major dental work, most plans are not generous when it comes to paying for major dental work, most plans cover less than 50 percent of the cost of major treatment. Most plans limit the benefits--both in number of procedures and dollar amount--that are covered in a given year. Be aware of these restrictions when choosing your plan and as you and your individual or family dental specialists develop treatment best suited for you. Major dental care includes:

Will the plan allow referrals to specialists? Will my individual or family dental office and I be able to choose the specialist? Some plans limit referrals to specialists. Your individual or family dental assistance may be required to refer you to a limited selection of specialists who have contracted with the plan's third party. You also may be required to get permission from the plan administrator before being referred to a specialist. If you choose a plan with these limitations, make sure qualified specialists are available in your area. Look for a plan with a broad selection of different types of specialists. If you have children, you may prefer a plan that allows a pediatric dental specialist to be your child's primary care. Since specialized treatment is generally more costly than routine care, some plans discourage the use of specialists. While many general practitioners are qualified to perform some specialized services, complex procedures often require the skills of an individual or family dental technician with special training. Discuss the options with your individual or family dental procedure provider before deciding who is best qualified to deliver treatment. Can you see the individual or family dental office with the insurance you have when you need to, and schedule appointment times convenient for you? Individual or family participating in closed panel or capitation plans may have select hours to see plan patients. They may schedule appointments for these patients on given days, or at specified hours of the day, restricting your access. Some individual or family dental providers charge fees for seeing you on weekends or during emergencies are high than those the plan allows. You may be required to pay additional costs yourself. If you select these types of plans, have a clear understanding of your dental provider policies as well as the plan's dentist-to-patient ratio. It's the best way to ensure your access to care is not unduly restricted and that you are not surprised by higher fees the plan does not cover. Insurance companies do their best to ensure that their policyholders understand their plans and benefits, but it is up to an individual to make sure that they are making informed choices. The differences in the various plans you can choose from are:

Understanding these differences will enable you to make an informed decision when selecting a dental plan that is best for you or your family. |

Most of the best individual

dental insurance plans require you to satisfy waiting periods and deductibles

before having major and sometimes even minor restorative work done but not all

of them. Best dental

plans help make maintaining good oral

health a lot more affordable...and, with no waiting periods or complicated

coverage procedures, dental discount plans are about as simple as you can get.

Keep in mind family dental plans vary by price and dental benefits sometimes

based on the dental providers in the network.

Most of the best individual

dental insurance plans require you to satisfy waiting periods and deductibles

before having major and sometimes even minor restorative work done but not all

of them. Best dental

plans help make maintaining good oral

health a lot more affordable...and, with no waiting periods or complicated

coverage procedures, dental discount plans are about as simple as you can get.

Keep in mind family dental plans vary by price and dental benefits sometimes

based on the dental providers in the network. This type of dental insurance

plan pays the best when it comes to individual or family dental coverage on a

traditional fee-for-service basis which is helpful when deciding to buy coverage

for babies, kids, young teens, and especially seniors. Remember, a monthly

premium is paid by the client and/or the employer to a dental plan insurance

company, which then reimburses the family or individual dental office with

dental insurance for the services rendered. An insurance company usually pays

between 50% - 80% of the individual or family dental office fees for a covered

procedures; the remaining 20% - 50% is paid by the client.

This type of dental insurance

plan pays the best when it comes to individual or family dental coverage on a

traditional fee-for-service basis which is helpful when deciding to buy coverage

for babies, kids, young teens, and especially seniors. Remember, a monthly

premium is paid by the client and/or the employer to a dental plan insurance

company, which then reimburses the family or individual dental office with

dental insurance for the services rendered. An insurance company usually pays

between 50% - 80% of the individual or family dental office fees for a covered

procedures; the remaining 20% - 50% is paid by the client.  These plans often have a

pre-determined or set deductible amount which varies from plan to plan.

Indemnity plans also can limit the amount of services covered within a given

year and pay the individual or family dental offices based on a variety of fee

schedules. Some typical features of these plans:

These plans often have a

pre-determined or set deductible amount which varies from plan to plan.

Indemnity plans also can limit the amount of services covered within a given

year and pay the individual or family dental offices based on a variety of fee

schedules. Some typical features of these plans: